Introduction

This article, co-authored by my colleague Priya Sreenivasan and I, was originally published by the Global Mining Review. This version of the article has been modified as appropriate to suit the needs of this audience.

The article covers major aspects of the cobalt market including:

Volatility: The price of cobalt has been fluctuating as the balance of supply and demand shifts. Overall, oversupply has depressed cobalt prices in the recent past and the major cobalt producer, Democratic Republic of the Congo (DRC), has moved to ban cobalt exports to stabilize cobalt prices. Low cobalt prices have lowered the viability of new cobalt mines in North America.

Ethics: Despite seemingly greater media attention to cobalt traceability, the social and environmental impacts of cobalt mining have barely been addressed. The escalation of the ongoing conflict in the Eastern part of the DRC is expected to make it even more challenging to achieve cobalt traceability. Establishment of local mines in North America is expected to reduce dependence on the DRC’s cobalt thus environmental and social harms associated with cobalt production in the country.

Circularity: recycled cobalt is currently a significant source of the cobalt consumed in North America. The proportion of secondary cobalt is expected to increase with growth in lithium-ion battery (LIB) recycling. However, the economic viability of LIB recyling depends on spot metal prices which means the secondary cobalt stream only grows during boom cycles, when exclusively left to market forces.

Primary cobalt stream

Cobalt, a key component of lithium-ion batteries (LIBs), has long been identified as a mineral of strategic importance. It is key to making batteries more energy dense, allowing for the development of smaller batteries with longer discharge times for improving electric vehicle (EV) range and allowing safer charge-discharge cycles of LIBs which are prone to fires.

With : and utility-scale battery energy storage systems (BESSs) expected to form the backbone of the global energy transition, facilitating renewable energy integration into utility grids and decarbonising transportation, cobalt is now centre stage in the sharpened geopolitical and trade focus on critical minerals.

As a result, the cobalt market in 2024 showed a continued growth in line with previous years, with the Cobalt Institute reporting an 8% year-on-year increase in demand, compared to 2023, with the demand from EVs continuing to be the largest driver of the increased demand.

The Democratic Republic of Congo (DRC) was, and continues to be, the largest producer of the mineral and its global production share of 76% of the world’s cobalt continued to hold through the increased growth. Nine of the ten largest cobalt mines in the world are located in the Katanga District in the DRC, with the PT Halmahera Persada Lygend Project in Indonesia being the sole exception.

2024’s cobalt market was marked by significant and continual fall in cobalt prices. In August 2024, the cobalt price in Europe was US$26,000/t, a steep drop from its previous peak of around US$38,000/t in 2023 (see Figure 1), with production cuts from large suppliers like Glencore having little impact on the falling prices due to continued increase in supply from other producers such as Hong Kong-listed CMOC. The price fell to around US$10,000/t by December 2024. Further compounding the oversupply was Indonesia’s rise as a growing source of cobalt, predominantly from its operational nickel mines.

However, in February 2025, the trajectory of continually falling prices halted when the DRC government announced a four-month ban on all cobalt exports in an attempt to stabilise prices. The ban resulted in a sharp rise in prices and had an instant and significant impact on the cobalt market, with the third largest cobalt producer – Kazakhstan- based Eurasian Resources Group (ERG), (the largest and second largest producers being CMOC and Glencore) – declaring force majeure on cobalt deliveries in March 2025.

It should be noted that this is not the first time the DRC has enacted an export ban. In 2021, the DRC government instituted an export ban on cobalt concentrates to force producers to build smelting and refining capabilities within the country and prices surged after that ban as well.

Complicating an already dire and volatile cobalt supply concentrated in the DRC, the critical mineral’s production is riddled with reports of human rights abuses ranging from child and forced labour, inhumane working conditions, and rampant violence in artisanal mines.

The issue of cobalt traceability has taken on greater prominence as a result, putting enormous pressure on battery manufacturers (and further up the line, on EV and BESS producers) to publicly disclose the origins of the cobalt used in their batteries and audit their suppliers for human rights violations.

To further exacerbate the issue, in January 2025, the M23 group, allegedly backed by Rwanda, began advancing in the eastern region of the country. The violence from the ongoing conflict has the potential to impact the already fraught cobalt supply chain, with faked traceability documents for the minerals whose origins are muddled by blending the metal supply with that which is mined legally and in certified operations.

The dependence on cobalt has, over the years, given rise to various attempts to diversify sources of the mineral. As it stands, Indonesia is the only significant producer of cobalt outside of the DRC, albeit comprising only 7.3% of total global production in 2023, vastly behind DRC’s production share of 73% that year. The concentration is just as stark when it comes to the refining of cobalt, with the majority of the refining capacity located in China (see Figure 2).

Obvious concerns over national energy security have led to some attempts to mine and refine cobalt in North America. Canada currently has the third highest volume of global reserves after the DRC and Australia (see Table 1). The US has 0.6% of the total global cobalt reserves.

Country | Production (tonnes) as of 2023 | Mine Production % | Reserves (tonnes) as of 2023 | Reserves % |

|---|---|---|---|---|

DRC | 170,000 | 73.0 | 6,000,000 | 52.8 |

Indonesia | 17,000 | 7.3 | 500,000 | 4.4 |

Russia | 8,800 | 3.8 | 250,000 | 2.2 |

Canada | 5,100 | 2.2 | 600,000 | 5.3 |

Australia | 4,600 | 2.0 | 1,700,000 | 15.0 |

Madagascar | 4,000 | 1.7 | 100,000 | 0.9 |

Philippines | 3,800 | 1.6 | 260,000 | 2.3 |

Cuba | 3,200 | 1.4 | 500,000 | 4.4 |

Canada’s cobalt mines are predominantly located in the Atlantic province of Newfoundland and Labrador (43%), and in Ontario (33%), most of which are concentrated in primary nickel mines.

An almost equal tonnage of cobalt is refined in Canada, with refineries found in the prairie provinces of Alberta and Saskatchewan, as well as in Ontario, Manitoba, and Newfoundland and Labrador. The refineries in Canada process nickel and cobalt from the US and Cuba.

Despite the meteoric rise in cobalt demand in recent years, attempts to build new operational mines and refineries in North America have faced stumbling blocks. The first ever cobalt mine to open in the US in the recent decades was inaugurated in Idaho, with great expectations of building up local cobalt production capacity and addressing the various supply chain and security issues that the dependency on imported cobalt had provoked. However, the global price volatility of cobalt resulted in the closure of the mine within a year of commencing operations.

In Canada, First Cobalt – which was renamed Electra Battery Materials in 2021 – is still in the process of expanding its existing refinery complex in Temiskaming Shores in Ontario to include cobalt, and ultimately aim for recycling battery material as well, with the primary focus of supplying the EV industry. The project has received funding from the provincial and the federal government, and partnered with Glencore, but is yet to turn operational despite being in the works since 2020. In August 2024, the US pentagon also announced funding for the refinery. However, as of March 2025, the refinery was still under construction after grinding to a halt in 2023.

Adding to the woes of new cobalt mining and refining projects, the ongoing trade war, tariff uncertainty, and shift ing energy policies have introduced significant uncertainty around the status of funding to the various embattled cobalt mining and refining projects in North America, indicating a continued dependence on the volatile and fraught imported supply, and casting doubt on the feasibility of having an integrated cobalt supply chain in North America.

Secondary cobalt stream

Could economic growth be decoupled from potential environmental and social harm? What if the primary supply of cobalt could be supplemented with a more abundant source, or better yet, the ideal scenario in which cobalt could be obtained without digging a pit in the ground? This alternative source of cobalt is the secondary cobalt stream that comprises recycling of both pre-consumer (manufacturing scrap) and post-consumer waste of cobalt-containing products such as LIBs leveraged in consumer electronics, EVs, and BESSs. Environmental conservationists and battery supply chain actors have embraced the virtues of a circular approach to value supply chains, including reduced environmental pollution and improved resource adequacy.

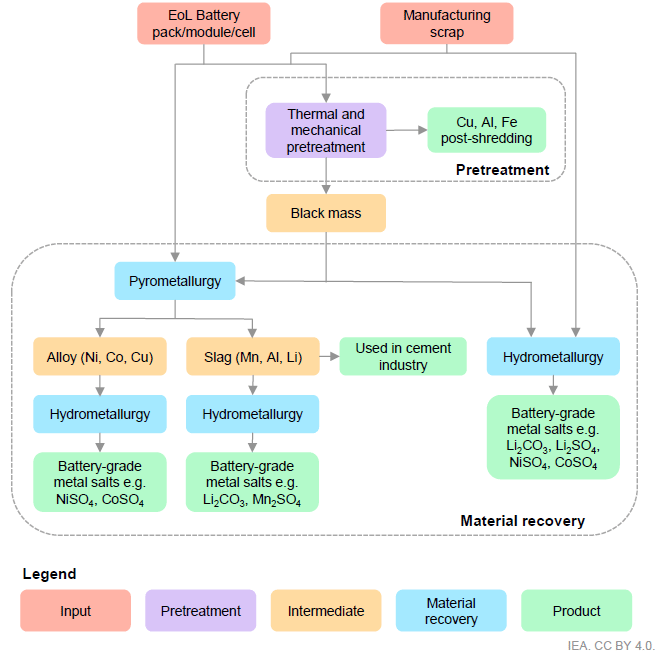

As shown in Figure 3, the process of recovering cobalt from an LIB involves two main stages, namely, pretreatment and material recovery.

Figure 3 LIB recycling process

Pretreatment involves the sorting and separation of the battery anode active material (AAM) and cathode active material (CAM) using techniques such as crushing, floatation, magnetic separation, and ultrasound. CAM proceeds to the next stage where it is subjected to purification techniques such as hydrometallurgy, pyrometallurgy, and hydro-pyrometallurgy. Hydrometallurgy typically employs an acid or ammonia to leach cobalt from the CAM and solvent extraction to separate cobalt from the leachates. In comparison, pyrometallurgy leverages high temperature to extract cobalt from the CAM through reduction smelting and high-temperature sintering reduction roasting. Hydro- pyrometallurgy leverages the strengths of each technique by utilising pyrometallurgy to produce intermediate cobalt compounds that demonstrate higher recovery rates during hydrometallurgy. Leaching can produce cobalt compounds with purity levels exceeding 99%.

Region | 2023 | 2030 |

|---|---|---|

North America | ~150 | 2,000 |

China | ~4,000 | 15,000 |

In its Recycling of Critical Minerals report, the International Energy Agency (IEA) states that the global volume of secondary cobalt (from all feedstocks) in 2023 was approximately 24 kt, which translates to 10% of total global cobalt demand. For the LIB feedstock, North America accounted for approximately 5% of global pretreatment capacity and about 2% of material recovery capacity as of 2023, as depicted in Table 2. At a national level, the United States Geological Survey’s (USGS) annual cobalt report for 2023 indicates that the US produced 2.1 kt of secondary cobalt largely from scrap feedstock. The production level decreased by about 4.7% in 2024.15 At an even more granular level, Table 3 shows the production capacities of operational facilities of leading LIB recycling companies in North America.

Company | Product | Annual production capacity (MT) |

|---|---|---|

Agmet Metals | Mixed metal intermediates | 50,000 (recyclables) |

Ascend Elements | Black mass | 30,270 (LIBs) |

Cirba Solutions | Black mass, cathode precursor | 28,980* |

Interco – A metaltronics Recycler | Black mass | 24,000* |

Glencore | Mixed alloy | 20,000 (recyclables) |

INMETCO | Mixed metal | 10,000* |

Clean Earth | Mixed alloy | 5,015* |

Redwood Materials | Battery grade cathode materials | 40 (LIBs) |

Li-Cycle | Black Mass | 0.051 (electronic waste) |

*Assumed to be LIBs

Based on announced projects, IEA expects an increase of the proportions of both global pretreatment and material recovery capacities in North America to 10% by 2030 for a total combined capacity of 2 MT. Major companies leading this expansion in North America will be Ascend Elements and Cirba.

In comparison, China hosted over 80% of both global battery pretreatment and material recovery capacity in 2023. The proportion is expected to remain the same for pretreatment, but reduce slightly to 75% for material recovery by 2030 for a combined total capacity of approximately 15 MT.

Regarding secondary cobalt consumption, 25% of approximately 8 kt of cobalt consumed in the US in 2024 came from secondary sources. Despite its large LIB recycling industry, the proportion of secondary cobalt in China’s cobalt consumption is not publicly available.

The growth of any industry is dependent on its economic viability, and cobalt recycling is not immune to this general rule. Enter the economics of cobalt recycling which are subject to three main factors: cobalt sport price, recycling technology, and location.

Cobalt spot price

The demand and price of secondary cobalt is dependent on the supply and price of primary cobalt. As such, the peak demand and price of secondary cobalt coincided with the record demand for cobalt observed between 2016 and 2022. At its peak in 2018, the price of cobalt in the London Metal Exchange (LME) reached approximately US$95, 000/t, which led cobalt consumers to seek secondary cobalt sources.

Recycling technology

The recycling technique and infrastructure utilised determines the recovery rates and quality thus the cost of producing secondary cobalt. Hydrometallurgy is the dominant metal recovery process with around 90% of the capacity due to advantages such as higher recovery rates, higher purity, and lower energy consumption compared to pyrometallurgy.

Location

Geographical location influences policy and operation cost. National and regional mandates for cobalt recycling rates and carbon emission limits for cobalt production introduce green premiums which boost the value of secondary cobalt. Lower labour and material costs, as well as effective collection and sorting infrastructure, also increase the profitability of cobalt recycling.

Impact analysis

The IEA expects demand for cobalt to outgrow primary supply by 2035. In the stated policies scenario (STEPS), which is based on the prevailing rate of the energy transition, secondary cobalt accounts for around 15% of total cobalt demand by 2035, up from 10% in 2023. The achievement of this approximately 2.5-fold increase will only be possible if the three factors discussed above align.

Cobalt demand and spot price have largely been driven by China’s economic growth given China’s status as the largest refiner and consumer of the metal. Positive economic growth in China portends a growth of the secondary cobalt stream while negative growth will have the opposite effect. The ongoing volatility of tariff rates between the US and China could lead to a global economic recession which would cause a reduction in cobalt demand and a decrease in cobalt spot prices, and thus a decline in secondary cobalt prices.

The improvement of recycling infrastructure to yield lower equipment cost and higher performance will lead to lower capital and operating expenses for cobalt recyclers. The major financial drawback of pyrometallurgy is the high energy costs mainly incurred in the smelting process. Innovations aimed at increasing the energy efficiency of furnaces such as microwave heating can yield operational cost savings to recyclers thus lowering production costs.

The Achilles’ heel for hydrometallurgy is the high material cost and environmental impact associated with the leaching and purification systems. Even higher cost savings could be potentially gained from direct recycling technology currently being commercialised by startup companies such as American Battery Technology Company, Altilium, Cylib, and Ascend Elements. Direct recycling entails the regeneration of the CAM without altering its chemical structure through cathode relithiation. This method promises to solve the main drawbacks of the traditional methods by consuming less energy and materials while producing higher yields.

On the policy front, the new European Union (EU) Battery Regulation, in effect as of 17 August 2023, established recovery mandates for cobalt used in industrial batteries of over 2 kWh capacity, EV batteries, starting, lighting, and ignition (SLI) batteries, and light means of transport (LMT) batteries. The regulation requires at least 16% of the cobalt content in a new product introduced into the EU market to be sourced from secondary streams by 18 August 2031. The mandated proportion increases to 26% on 18 August 2036. In comparison, the global battery cobalt recycling rate as a proportion of recycling feedstock was around 43% in 2023. Extended producer responsibility (EPR) schemes in other jurisdictions including the US, China, South Korea, India, and Canada are also expected to boost the production of secondary cobalt.

Overall, economic growth, technological advancements, and recycling policies are expected to drive a 50% increase in the proportion of secondary cobalt in total cobalt demand by 2035, even without increased regulatory support in North America and driven solely by the realities of production volatility, energy security, and geopolitics.

Conclusion

While North America holds a relatively small proportion of both global primary cobalt reserves and refining capacity, the potential of the secondary cobalt production industry holds enormous promise for securing domestic supply and creating a new market. It also holds the tantalising prospect of creating a viable alternative supply option for the mineral, with clear traceability and a competitive edge centred on improved value to the worker. Additionally, lowered environmental impacts facilitated by reducing requirements for greenfield mining development and transportation also transitions the activity to a truly circular, sustainable model.