Happy New Year! Welcome to the latest edition of FairGreen where we talk about LDES commercialization in the context of the energy trilemma.

This newsletter is packed with insights on LDES manufacturing, financing and deployment.

Capital Stack

Our anchoring question today is: how have LDES projects been financed across time, geographies and technologies?

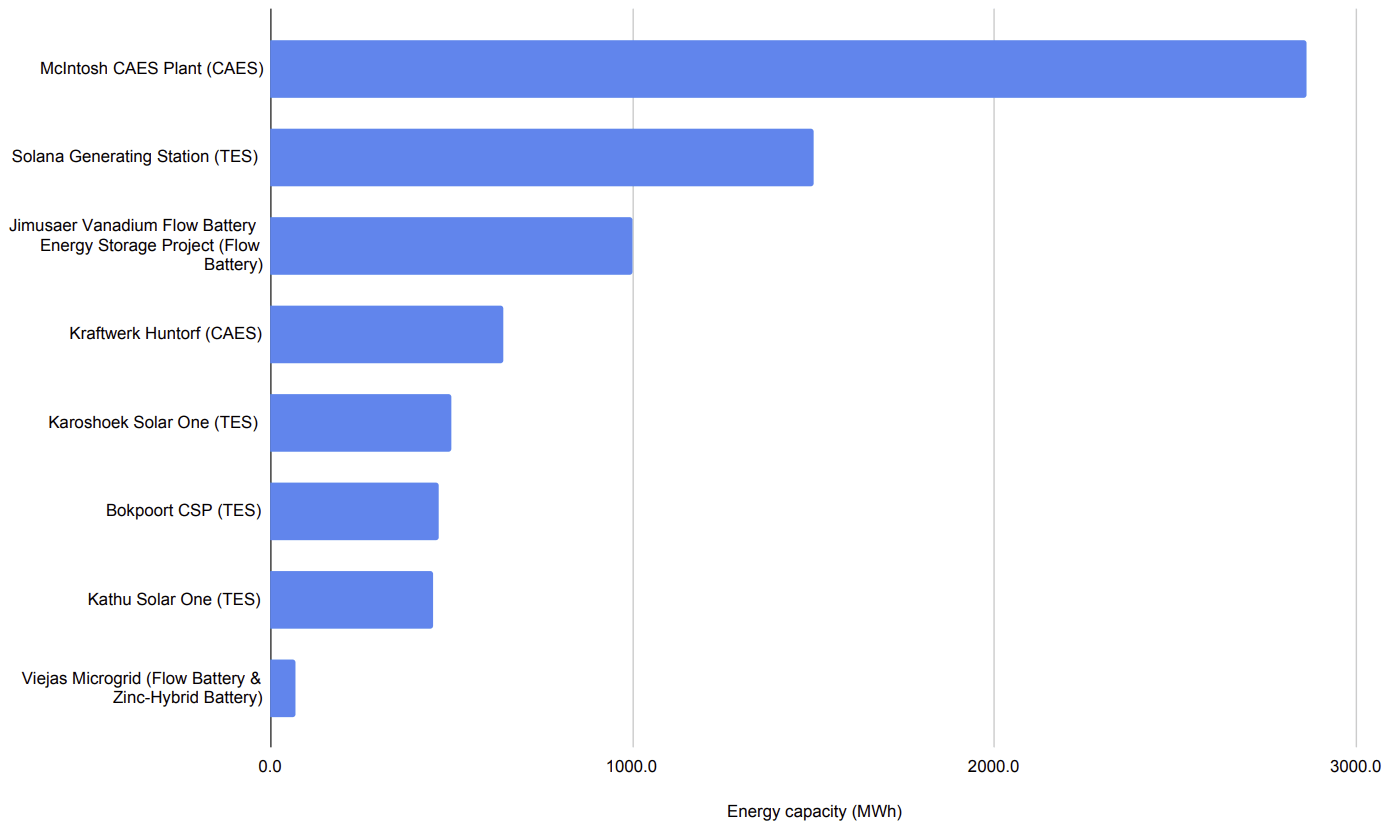

Let’s explore the financing structures of some notable LDES projects globally (selected for their capacity and financing structures).

A brief description of typical financing instruments for commercial LDES projects is provided below.

Debt: consists of senior debt and junior debt which differ in terms of interest rates. Junior debt is used bridge funding gaps left by senior debt and equity. Typically the largest portion of a project’s capital stack.

Equity: includes common equity provided by the project developer and strategic equity investors, and tax equity involving institutions trading equity for tax credits.

Grant: catalytic funding provided by public entities to de-risk debt and equity investments. It absorbs financial viability risk in the absence of debt financing.

The table below shows the proportions of financing instruments in the capital stacks of some notable LDES projects. The type of project revenue stream has a huge influence on the capital stack hence its inclusion in the table.

(PPA = power purchase agreement)

Project (COD) | Sponsor | Offtake | Grants | Senior Debt | Equity | Notes |

|---|---|---|---|---|---|---|

McIntosh CAES* (1991) | Power-South | Utility-owned | <5% | - | >95% | Common equity |

Solana CSP & TES (2013) | Abengoa Solar | 30-year PPA | - | ~72.5% | ~27.3-28.3% | Common and tax equity |

Jimusaer VFB* | CTG | Utility-owned | - | - | ~100% | Sponsor equity |

Kraftwerk Huntorf CAES* (1978) | NWK; Uniper Kraft-werke | Utility-owned | - | - | ~100% | Sponsor equity |

Karo-shoek Solar One CSP & TES* (2018) | Karo-shoek Solar One | 20-year PPA | - | ~70-75% | ~25-30% | Common equity |

Bokpoort CSP & TES (2016) | ACWA Power | 20-year PPA | - | ~70-75% | ~25-30% | Common equity |

Kathu Solar One CSP & TES (2019) | Engie | 20-year PPA | - | ~70% | ~30% | Common equity |

Viejas VFB & Zinc-Hybrid (2025) | Indian Energy | 30-year PPA | ~28.9% | ~66.7% | ~4.5% | Common and tax equity |

*Indicative capital stack based on similar projects

Average current capital stack mix :

High equity: 100% of the projects

Low senior debt (adjusted for loan guarantees): 37.5%

Low grant: 25%

Insights

Temporal variations

Corporate balance sheet financing: the 2 CAES projects were financed by the balance sheets of the utilities involved pre-2000.

Project financing: the funding of the 4 TES projects in the 2010s was driven by favorable government policies including fiscal incentives and procurement programs.

Geographic variations

South Africa: debt and equity funding are promoted by government policy that guaranteed revenue via PPAs with the national utility ESKOM under procurement programs such as REIPPPP.

United States: loan guarantees by the US Department of Energy (DOE) are encouraging debt financing by reducing default risk for lenders. Additionally, fiscal incentives such as tax credits are encouraging the entry of tax equity financing into the LDES market.

China: LDES projects are reliant on state-backed financing facilitated by state-owned enterprises (SOEs) and policy banks. Lack of financial disclosures makes it difficult to determine project capital stacks.

Technological variations

Mechanical and thermal: the 2 CAES and 4 TES projects leveraged standard equipment with low technology risks. Product/system bankability matters for debt financing.

Electrochemical: little/no operational fleet data makes it difficult for non-lithium battery technologies to attract debt financing.

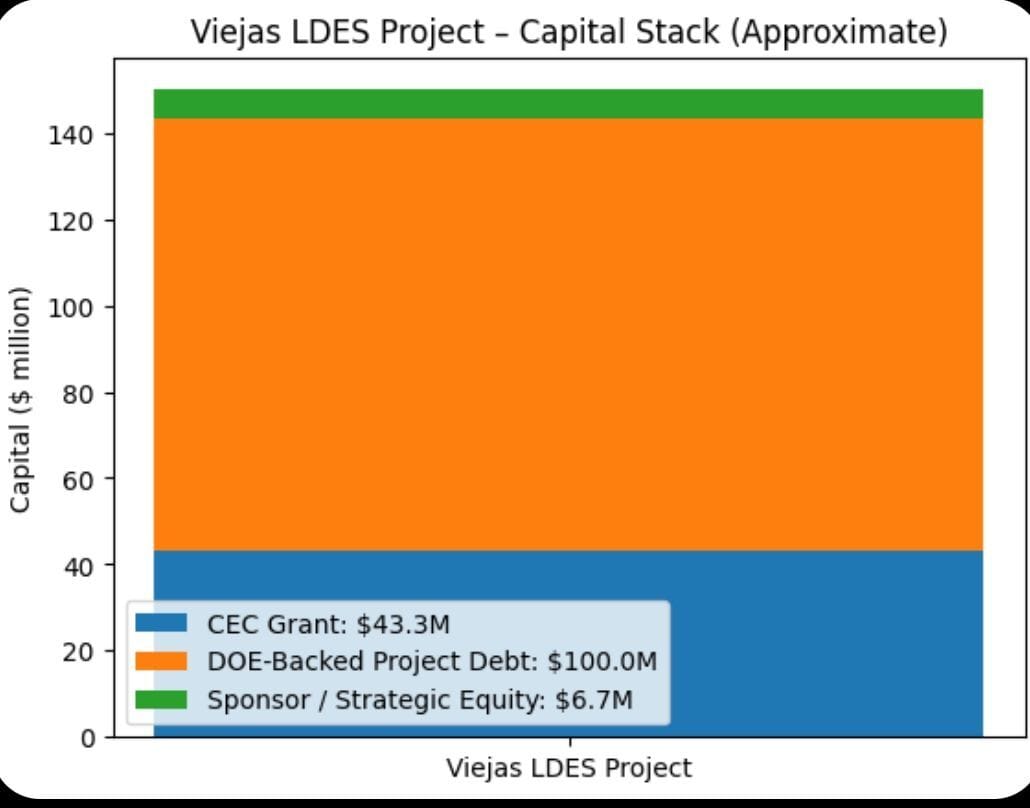

Case Study

Project details

Location: Alpine, CA

Capacity: 7 MW / 70 MWh

Developer: Indian Energy LLC

ESS provider(s): Invinity Energy Systems; Eos Energy Enterprises, Inc.

Offtake: 30-year PPA with Viejas Band

Total project cost: ~$150 million

Capital stack

Grant: $43 million by CEC

Debt: <= $100 million loan by US Bank National Association (backed by $72.8 million US DOE LPO loan guarantee)

Tax equity plus bridge funding: $6.7 million. Tax equity investors were U.S. Bank Impact Finance and Starbucks.

Conclusion

Current LDES project capital stacks are characterized by high grant, high equity and low debt financing, which is typical for pre-bankable assets.

Debt financing is a reliable indicator of project bankability, without which most LDES projects will remain at demonstration scale.

Where are we now?

South Africa is leading the way in making debt financing more accessible to LDES projects by guaranteeing project revenue through long-term PPAs.

The UK has adopted a different flavor of the revenue-guarantee approach through its ongoing cap-and-floor scheme.

What do other LDES markets need to do?

Create risk allocation mechanisms such as revenue guarantees, contractual risk transfer and performance guarantees.

In Case You Missed It

Join the Global LDES Commercialization Forum on LinkedIn for further discussions on LDES commercialization with the global LDES community: [Link to group]

Get a front-row seat on LDES commercialization through the LDES Tracker: [Link to Tracker]

This newsletter strives to become your #1 LDES commercialization education partner. Remember, consistency is key!

Let us know how we are doing.

Until next time :)